Comparing life insurance products online

New Web portal to help consumers make informed decisions about what policy to buy and how much coverage to get.

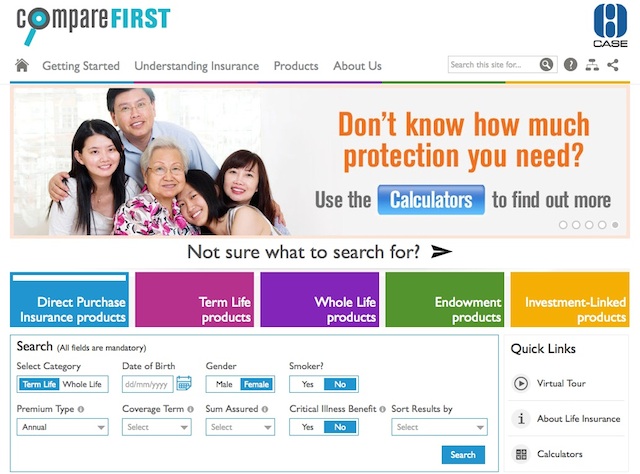

Consumers can quickly compare the premiums and features of similar life insurance products by different insurance companies using a new Web portal called compareFIRST, an initiative by Consumers Association of Singapore (CASE), Monetary Authority of Singapore (MAS), Life Insurance Association Singapore and MoneySENSE.

This initiative will help consumers make informed decisions about what policy to buy and how much coverage to get. Consumers who wish to purchase life insurance products should approach their financial advisory representative or life insurance company. The types of life insurance products available for comparison are term-life insurance, whole-life insurance, endowment insurance and direct insurance.

There is also a listing of general product information on investment-linked products, which are not easily compared given the varied features of the products. Consumers can navigate the site via type of insurance or product listing. They can also search for various criteria such as sum assured, benefits or premium prices, amongst others.

Also early this week, life insurance companies have started selling direct purchase insurance (DPI). These simple life insurance products are sold without financial advice, no commission is charged and consumers pay lower premiums than comparable life insurance products.

They consist of term life and whole life with total and permanent disability cover, with an optional critical illness rider. Consumers can insure themselves for up to S$400,000, with a maximum coverage of S$200,000 for whole life DPI, with each insurer.

** To find out more about DPI – go to MoneySENSE at www.moneysense.gov.sg/understanding-financial-products/insurance/types-of-insurance/life-insurance/types-of-life-insurance/direct-purchase-insurance.aspx.

0 Comments